This additionally helps setting costs https://www.kelleysbookkeeping.com/ that cover costs and ensure profitability. Service businesses don’t have items to sell, but they still have a value of sales. Right Here, it’s largely about the cost of labor and any materials wanted to ship the service. Maintaining these costs in verify is essential for maintaining profitability. Interpreting Cost Of Sales Data If you haven’t decided on a method but, factor in how each may affect your value of products sold. For more info on how to decide an inventory valuation method, learn our FIFO vs. LIFO explainer. Whitney Vandiver writes for NerdWallet, presently specializing in house companies, and has been printed in The Washington Publish, the L A Times, The Seattle Instances and The Independent. When she's not writing, she enjoys reading with a hot latte and spending time along with her family. We imagine everyone should be succesful of make financial selections with confidence. Leverage the complete capabilities of Lark Sheets to document, observe and collaborate in your accounting tasks initiatives. Automate Guide Processes By understanding these key aspects, companies can effectively make the most of cost of sales as a priceless device for monetary analysis and decision-making.For instance, COGS for an automaker would come with the fabric costs for the elements that go into making the automobile plus the labor costs used to put the car collectively.These acquisitions, combined with the opening inventory, kind the idea for calculating the whole items available on the market.Nike, the large footwear and apparel …

Understanding Cost Of Gross Sales: A Whole Guide

This additionally helps setting costs https://www.kelleysbookkeeping.com/ that cover costs and ensure profitability. Service businesses don’t have items to sell, but they still have a value of sales. Right Here, it’s largely about the cost of labor and any materials wanted to ship the service. Maintaining these costs in verify is essential for maintaining profitability.

Interpreting Cost Of Sales Data

If you haven’t decided on a method but, factor in how each may affect your value of products sold. For more info on how to decide an inventory valuation method, learn our FIFO vs. LIFO explainer. Whitney Vandiver writes for NerdWallet, presently specializing in house companies, and has been printed in The Washington Publish, the L A Times, The Seattle Instances and The Independent. When she’s not writing, she enjoys reading with a hot latte and spending time along with her family. We imagine everyone should be succesful of make financial selections with confidence. Leverage the complete capabilities of Lark Sheets to document, observe and collaborate in your accounting tasks initiatives.

Automate Guide Processes

- By understanding these key aspects, companies can effectively make the most of cost of sales as a priceless device for monetary analysis and decision-making.

- For instance, COGS for an automaker would come with the fabric costs for the elements that go into making the automobile plus the labor costs used to put the car collectively.

- These acquisitions, combined with the opening inventory, kind the idea for calculating the whole items available on the market.

- Nike, the large footwear and apparel model, is an example publicly traded company that makes use of the value of gross sales in its monetary statements posted on its annual 10-K report.

Your balance of purchases account, at the end of the reporting period, is moved to your inventory account. This is shown as a debit to your stock and credited to your purchases account. The result’s a e-book stability in your stock account that equals your actual ending inventory amount. In retail, the cost of gross sales may even embrace any payments made to manufacturers and suppliers for the purchase of merchandise that you have bought.

Accounting For Cost Of Goods Offered

Efficient management of labor prices can result in improved productivity and lowered expenses, benefiting the company’s financial well being. When we speak about the price of gross sales and the price of items offered, we see the use of totally different terminology throughout industries and regions cost of sale but the underlying concept is identical. Each are part of the revenue statement and serve as key metrics for evaluating the revenue and operational efficiency of a enterprise. Value of goods offered contains all of the direct costs tied to producing or procuring the goods and providers you promote in your small business. Nonetheless, for service-based businesses, this metric is extra generally often identified as “price of companies” or “value of sales.”

Basically, each phrases are interchangeable and seize any costs linked to producing a services or products. This can lead to corporations grouping these bills together for simplicity and readability in their financial reporting. COGS measures the value of producing a product from uncooked supplies and components.

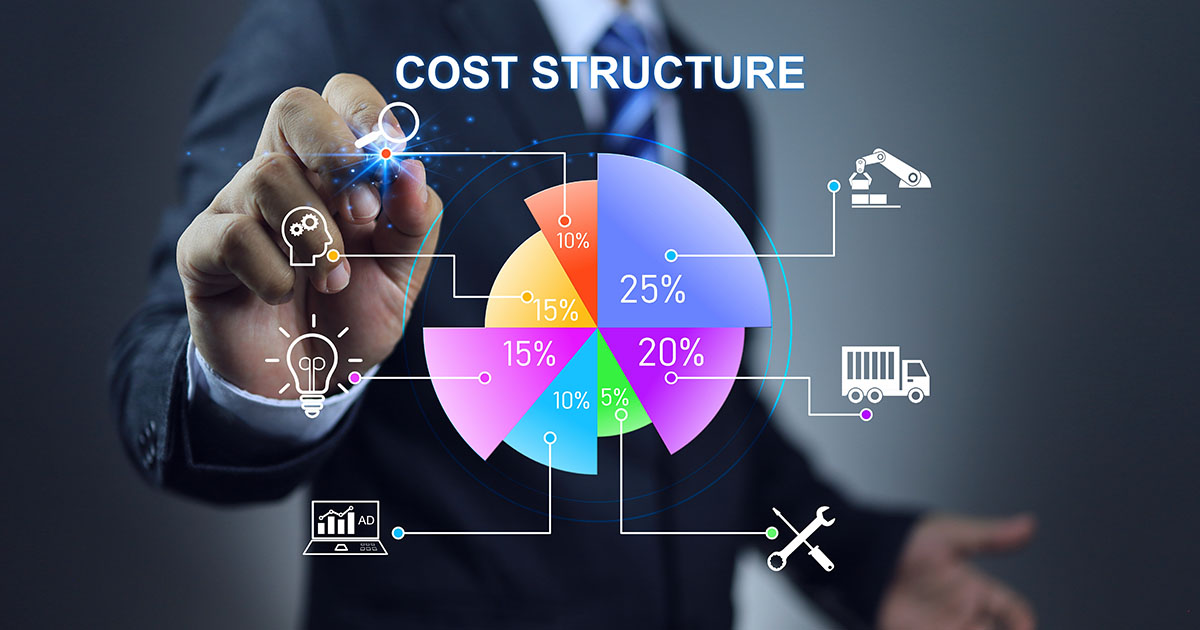

This calculation is crucial in various different elements as properly, corresponding to inventory administration, financial reporting, value control, and taxation. Gross revenue margin, a key metric on this evaluation, measures the proportion of income retained after accounting for the price of sales. A high gross revenue margin signifies environment friendly cost management and robust pricing strategies, offering a stable basis for covering oblique prices and attaining net profitability.